Venture debt financing is a strategic part of a growing SaaS company’s financial arsenal. Practical and useful for young businesses as well as those with annual revenues well into the millions, the benefits of debt financing extend well beyond just being a source of funding for growth. They include flexibility and options — benefits that don’t come with other forms of financing, like bank loans, angel investors, and venture capital investments.

Venture debt financing is a strategic part of a growing SaaS company’s financial arsenal. Practical and useful for young businesses as well as those with annual revenues well into the millions, the benefits of debt financing extend well beyond just being a source of funding for growth. They include flexibility and options — benefits that don’t come with other forms of financing, like bank loans, angel investors, and venture capital investments.

Here, we’ve gathered some insights on debt financing ranging from why companies use debt as a funding source to how debt can result in higher takeaways for SaaS company owners upon selling versus equity financing.

Why Do Companies Take on Debt in the First Place?

Many companies — not just SaaS — take on debt as part of their growth strategy. Just as with any financial plan, the benefits of debt must be considered with respect to circumstance. For example, maybe you started a company and offered each new employee equity in the company as part of their compensation package. Maybe you secured a round of funding early on, adding investors to your board and leadership team.

In these scenarios, you as the business founder and/or owner don’t have full ownership of the company. Regaining that might be part of your long-term goal. This is one of the most common reasons why companies take on debt as standalone funding. Essentially selling a percentage of your ownership in the business to an equity investor might seem like a solution for funding, but it will be important to remember that arrangement brings the investor into your daily operations. Equity investors do offer valuable resources, support, and insights, but as a portion of your business is within their control, their opinions can easily become decisions.

Another reason SaaS company owners and leaders obtain debt financing is to resolve situations just like this. As your company transitions from one stage of growth to the next, a component of your strategy might include buying back equity from early employees or equity investors. Video software company Wistia recently assumed debt for this exact purpose: to say thanks to early employees, to remove the employee stock option due to the decision not to sell, and to buy back equity from their investors.

Another common use of debt is for bridge financing between raise rounds. If you’ve gone through the process of pitching for funding, talking and meeting with investors, and navigating the skyscraper of paperwork that comes with venture sponsorship, you’ll know that it’s quite the undertaking and that it takes quite a bit of time.

Bridge financing helps you maintain operations in the interim, allowing your growth to continue and putting you in a better position for your next raise round. It allows you to extend your cash runway for months or even longer, depending on your situation. Conversely, if you already have strong cash flow, yet still need investment to take your company to the next level, debt financing helps you receive funding without giving up equity.

Explore this topic in-depth: Download our free guide on the advantages of debt.

Debt Financing Advantages on the Loan Side

Additional benefits of debt lie in the terms and structure of the loan itself. Whereas bank loans require collateral (which most SaaS companies don’t have) and impose strict, rigid terms (that force SaaS companies into a corner), debt financing is often much more accommodating.

For example, debt financing advantages at River SaaS Capital include allowing our clients to receive tranches — a portion of a loan. This allows them to save on interest over the life of the debt. A bank would be more likely to provide funding in the form of a lump sum and require the borrower to pay interest on that sum, increasing the overall amount paid by the borrower.

Other benefits of debt involve the manner of repayment. We allow our borrowers to enjoy repayment terms that scale to the financial growth of their company, making it easier to focus on growth and repay the loan. Other repayment options include revenue sharing on post-investment earnings. Ultimately, the structure of the loan and method for repayment are both flexible. In some cases, step-up loans and balloon payments are an option. We’ll work with you to find options based on what you can afford now versus what you can afford later.

A final debt financing advantage includes re-borrowing paid principal. This might occur toward the end of your repayment schedule with a situation or circumstance that requires another boost. Whereas this would be unlikely with a bank loan or other form of investment, debt financing lenders offer this flexibility as an advantage of going this route for your funding. That’s because the right debt financing partner will truly want you to grow and succeed — not just collect interest on your loan.

Understand the Risk of Debt Financing

As with any other type of loan, there are risks associated with debt financing. It should come as no surprise that debt financing features an interest rate. However, what we often find with SaaS companies that approach us for non-dilutive capital is concern regarding the rate itself. Carefully consider this in relation to your overall strategy and goals. Many SaaS companies accept the interest rate on venture debt because they remain in complete control of the business, don’t have to give up a board seat, and the amount of time needed to receive funds is shorter.

Another consideration is collateral. Whereas other forms of financing require collateral like real estate, equipment, accounts receivable, etc., debt financing typically requires intellectual property as collateral. As with the interest rate, this must be evaluated and balanced in terms of risk at your organization.

If you browse our What is Venture Debt? page, you’ll see that we prefer to work with SaaS companies that already have strong cash flow (though profitability isn’t required) as well as a sticky subscriber base. In these circumstances, repayment isn’t a significant concern — particularly for the many flexible options available that we discussed above. If an infusion of working capital can help you achieve your growth goals while making consistent payments on your loan, you as a business owner may not have a problem with using IP as collateral.

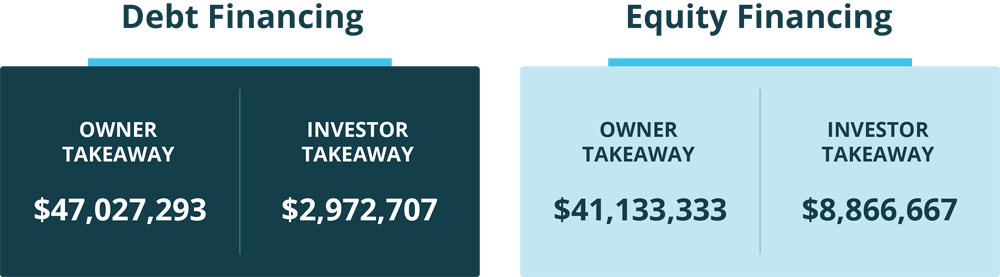

While the risk of debt financing is something you as a SaaS owner or leader must carefully weigh, there are significant benefits to going with debt financing over equity financing — especially should you decide to sell. Say your business was worth $10 million before getting funding, and you received $2 million in growth capital via debt financing. Based on a sale of $50 million four years later, here’s what your takeaway could look like.

Get Started with River SaaS Capital

Offering both venture debt financing and equity financing solutions, we provide the flexibility and partnership your SaaS company needs to achieve its growth goals. Contact our investment team using the form below, or apply online quickly and easily here.