Explore this topic in-depth: Download our guide to growing in a competitive market.

Understanding SaaS Revenue Segments

As a SaaS company, your revenue primarily comes through subscriptions to your platform. But the sources of those subscriptions compared against customer size are what make up your SaaS revenue segments. You may have multiple sources across digital and non-digital channels, but often, they can be grouped into 1) outbound, 2) inbound, and 3) partner.

As a SaaS company, your revenue primarily comes through subscriptions to your platform. But the sources of those subscriptions compared against customer size are what make up your SaaS revenue segments. You may have multiple sources across digital and non-digital channels, but often, they can be grouped into 1) outbound, 2) inbound, and 3) partner.

Outbound sources would include any customers gained through traditional marketing efforts, like advertising, cold calling, mass email marketing, and media buys. Inbound sources would include customers earned through paid search engine marketing, content marketing, paid social media, and opt-in email marketing. Customers earned through partner marketing would have come through referrals, recommendations, and collaborations — within a specific or entirely unique market.

In a recent presentation, former HubSpot CRO and Harvard Business School Senior Lecturer Mark Roberge aligned these three customer sources with three standard customer sizes: 1) small and midsize businesses (SMBs), 2) mid-market, and 3) enterprise. Why compare these two data groups? To help SaaS businesses identify the best revenue segments for their businesses.

Placing customer source and customer size on X and Y grids respectively generates a nine-square grid that SaaS companies can use to identify the segments that are worth experimenting in, scaling, or avoiding entirely.

What Segments Are Right for You?

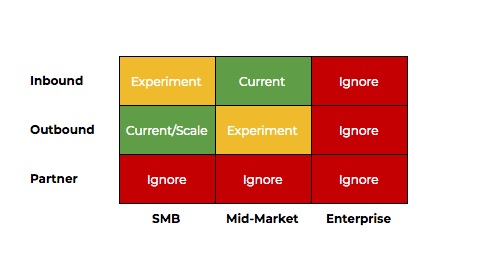

Thankfully, you already have a starting point: where your initial product-market fit and go-to-market fit positioned your platform when you began. Let’s say your platform solves a specific compliance problem for small, independent medical facilities (i.e., SMBs). When you founded the company and launched the platform a few years ago, there was practically no search around the problem, so inbound marketing wasn’t the best channel for growth.

You just needed to get the word out, so you primarily conducted outbound marketing to cast a wider net — and it worked. Over a couple of years, you successfully grew your customer base from just 10 customers who were willing to join up in exchange for discounted pricing on future features to nearly 1,000.

However, over those years, mid-market companies began to find you by searching the new compliance rule and eventually finding you thanks to some properly keyworded pages on your site. You’ve grown that mid-market/inbound segment some, but it’s not close to the SMB/outbound segment.

Using Roberge’s model, you can identify your next steps for growing revenue from other segments. However, you shouldn’t just pick a random square on the grid. You need to experiment with a step adjacent to where you began based on whether there’s a product-market fit and a go-to-market fit. Your current segments are diagonal from one another, giving you two spots where it might make sense to experiment first.

It makes sense to experiment with the inbound/SMB channel, as those medical facilities will have a need for your platform to maintain compliance themselves, but it doesn’t make sense to go enterprise through any source because your platform cannot currently provide enough automation to support a nationwide group of medical facilities. The partner/SMB segment also doesn’t make sense financially, as revenue from outbound/SMB vastly outweighs the few opportunities that ever came in via a channel partner. However, it does make sense to try outbound marketing now that you have a few dozen mid-market companies who’ve experienced success with your platform.

This is a great method for identifying your next steps as a growing SaaS company. Rather than shooting for the stars (and subsequently shooting yourself in the foot), identify segments that make sense for your product, proven SaaS marketing channels, and your overall go-to-market strategy.

How Venture Debt Can Help

Regardless of which SaaS revenue segments you choose to pursue, it’s critical to understand their performance and how you’ll grow in each one. For example, mid-market/inbound is bringing in $1 million ARR but with a 16-month payback. That’s worth sustaining, but perhaps not scaling. Outbound/SMB brings in $3 million ARR with an 8-month payback. That’s where your bread and butter lies and is what you should focus on scaling while you experiment with other segments.

But when the time comes to experiment in those new SaaS revenue segments, you may find it a difficult endeavor to support. Keep in mind, you’re not just experimenting in new segments, but you’re also continuing to use resources to sustain mid-market/inbound while putting more resources into scaling up outbound/SMB. The latter two alone mean an increase in marketing spend before you even invest in experimenting with others.

This is where venture debt financing can support your growth goals. While equity financing requires a portion of ownership in your company, venture debt simply provides funding. You stay in control, which is critical for maintaining progress during experimentation.

Additionally, venture debt works best when it’s used to accelerate what you’re already doing well in sales and marketing. Funding can be used to scale up your existing SaaS revenue segments without worry of failure because they’re already performing strong. Revenue increases, and you can maintain your debt obligations (which are flexible based on your goals) while allocating other funding toward the experimentation segments.

If you’re looking to take your SaaS platform to the next level, but aren’t sure where to begin, start with the SaaS revenue segment exercise — and with a conversation with our team. We’d love to hear your story, discuss your goals, and see if there’s a good fit for our companies to work together. Fill out the form below to get in touch with us. If you’re ready to put our growth capital to work for your business, apply online quickly and easily.